About Us

Investment strategy

Weiss Korea Opportunity Fund (“WKOF”) invests primarily in listed South Korean preference shares trading at a discount to common shares of the same issuers. South Korean preference shares are equity shares that are generally entitled to receive the same dividends as common shares. Unlike the common shares, preference shares typically receive an additional fixed payment and have limited voting rights. As a result of their discount to the common shares, South Korean preference shares’ price-to-earnings ratios are typically lower and the dividend yields higher than their respective common shares.

Fund Information (as of 17 Dec 2025)

| Ticker (London) | WKOF | |

| Net Assets | £110,698 | |

| NAV/Share | £0.54 | |

| Price/Share | £1.20 | |

| Premium/(Discount) | 120.66% | |

| Median Premium/(Discount)1 | (2.43%) | |

| Dividend Yield2 | 3.40% | |

| Inception | 14 May 2013 | |

| Exchange | AIM | |

| ISIN | GG00BT26K977 | |

| SEDOL | BT26K97 | |

| Investment Manager | Weiss Asset Management LP www.weissasset.com | |

| Broker & NOMAD | Singer Capital Markets T: (44) 20 7496 3000 |

Fund Performance

Performance (as of 30 Nov 2025)

Performance (as of 30 Nov 2025)

| WKOF Inception to Managed Wind-Down |

Unannualized IRR Since Managed-Wind Down |

||

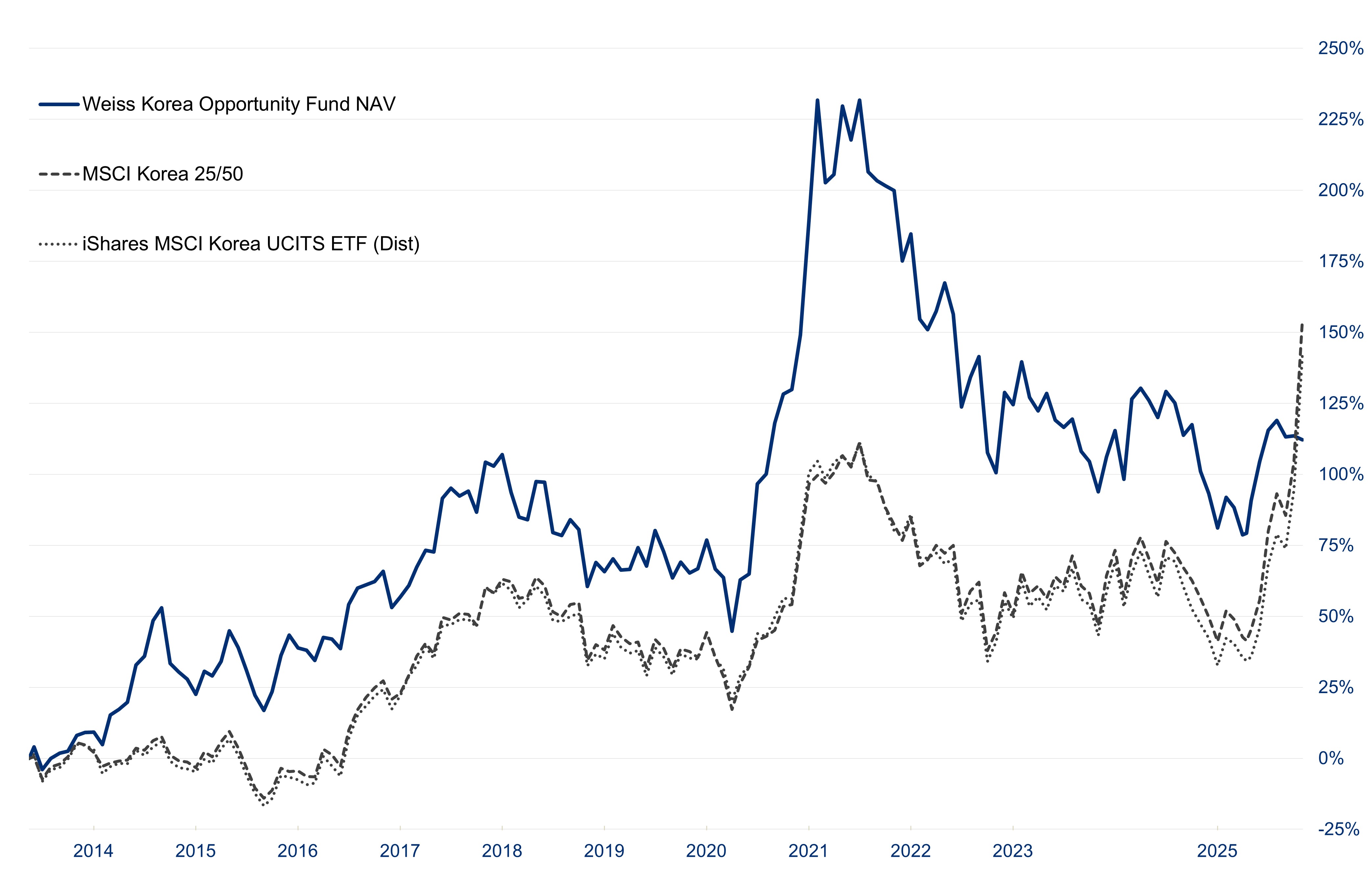

| Weiss Korea Opportunity Fund NAV3,4 | 79.2% | 36.6% | |

| MSCI Korea 25/50 4,5 | 41.4% | 70.3% | |

| iShares MSCI Korea UCITS ETF (Dist)4,5 | 34.3% | 68.3% |

Portfolio

Portfolio Statistics (as of 30 Nov 2025)

| Portfolio Discount7 | N/A | |

| Average Trailing 12-Month P/E Ratio of Preference Shares Held8 | N/A | |

| Trailing Net Dividend Yield of Preference Shares Held9 | N/A | |

| Percentage of NAV Invested in Preference Shares | 0.0% | |

| Net Cash Balance11 | 100.0% |

Top 10 Holdings12 (as of 30 Nov 2025)

| N/A | N/A | |

| N/A | N/A | |

| N/A | N/A | |

| N/A | N/A | |

| N/A | N/A | |

| N/A | N/A | |

| N/A | N/A | |

| N/A | N/A | |

| N/A | N/A | |

| N/A | N/A | |

| Top 10 Holdings | N/A |

The ‘Portfolio Discount’ in the Portfolio Statistics table represents the discount of WKOF’s actual NAV to the value of what the NAV would be if WKOF held the respective common shares of issuers rather than preference shares on a one-to-one basis.

Korean preference shares trading at wider discounts are most often less liquid than those at narrower discounts. The Investment Manager believes that it is in the interest of shareholders for WKOF to hold less liquid shares if they increase the expected return of the portfolio. The Investment Manager plans to rebalance WKOF’s portfolio, over time, toward preference shares trading at larger discounts, consistent with its view on the most attractive portfolio.

Investment Manager

Weiss Asset Management LP, a Delaware limited partnership formed on 10 June 2003, has been appointed by the Company as Investment Manager and is responsible for the management of the Company's assets pursuant to the Investment Management Agreement. The Investment Manager is registered as an investment adviser with the SEC.

The Investment Manager has combined assets under management of ₤2.9 billion as of 30 November 2024.

Weiss Asset Management LP was founded by Dr. Andrew M. Weiss, who received his Ph.D. in Economics from Stanford University, was elected a fellow of the Econometric Society in 1989, and is currently Professor Emeritus of Economics at Boston University.

The Investment Manager is principally owned by Dr. Weiss and certain members of the Investment Manager's senior management team. Dr. Weiss has more than 30 years of experience investing professionally. Dr. Weiss and the senior management team have significant investment management experience, particularly with securities trading at discounts to their fundamental value.

Endnotes

1. The median premium or discount of WKOF’s price per share relative to WKOF’s NAV per share, for all published NAVs for the period since inception to the date of this factsheet. Data sourced from Bloomberg.

2. Calculated as the dividend per share over the last 12-months divided by the share price as of the chart date.

3. On 04 April 2022, WKOF began reporting the NAV based on data as at the close of business in South Korea for all assets and FX rates. Dividends from WKOF’s underlying investments are accounted for in the NAV of WKOF on the relevant ex dates (or accrued on the ex date based on an estimated amount if the actual amount is unknown). Whilst the estimated dividends, and therefore the estimated NAV, are prepared in good faith, there can be no guarantee that they are accurate in all respects.

4. For WKOF, this return includes all dividends paid to WKOF’s Shareholders and assumes that these dividends were reinvested in WKOF’s Shares at the next date for which WKOF reports a NAV, at the NAV for that date. MSCI total return indices are calculated as if any dividends paid by constituents are reinvested at their respective closing prices on the ex date of the distribution. iShares MSCI Korea UCITS ETF UDS (Dist) also assumes reinvestment of dividends.

5. The MSCI Korea 25/50 Index (USD) (available on Bloomberg as “MSCI Korea 25/50 Net Total Return Index”) is reported in United States dollars. To calculate monthly returns in British pounds sterling, the monthly values provided by the index are converted into sterling at the exchange rate taken as of 4pm New York time on the last date of the prior month and on the last day of the applicable month, and accordingly, such returns may differ from indices using other conversion methodologies such as those that use the daily closing exchange rate on each trading day during a given month. Further information relating to the Index is set forth in the Admission Document, as the same may be amended or supplemented from time to time. The iShares MSCI Korea UCITS ETF USD (Dist) is reported in United States dollars. To calculate the monthly returns in British pounds sterling, the monthly values provided by the ETF are converted into sterling at the exchange rate taken as of 4pm London time on the last date of the prior month and on the last day of the applicable month.

6. Since inception of Weiss Korea Opportunity Fund on 14 May 2013. The WKOF return since inception is calculated on the basis of the Initial Net Asset Value per Ordinary Share.

7. Represents the discount of WKOF’s actual NAV to the value of what the NAV would be if WKOF held the respective common shares of issuers rather than preferred shares on a one-to-one basis.

8. The Average Trailing 12-Month P/E Ratio of Preferred Shares Held is based on the consolidated diluted earnings per share over the trailing 12-month period as reported by Bloomberg, and is calculated as the total market value of WKOF’s preferred share portfolio on the report date divided by the total earnings allocable to WKOF based on WKOF’s holdings on the report date. Investments with negative reported earnings are excluded.

9. Trailing Net Dividend Yield of Preferred Shares Held represents the weighted average dividend yield of the preferred shares owned by WKOF over the 12-month period ending on the chart date as reported by Bloomberg, after accounting for Korean taxes applicable to WKOF, and weighted by the market value of each investment on the report date. This figure does not estimate or forecast future dividend payments on WKOF's investments.

10. Number of Positions does not include credit default swaps or options held by the portfolio for hedging purposes.

11. Net Cash Balance includes cash and cash equivalents, net of accruals, and does not include credit default swaps or options held by the portfolio for hedging purposes, which account for the remaining percentage of NAV.

12. Top 10 Holdings is calculated using the market value of all holdings including portfolio hedges.

Disclaimer

The information contained on this webpage (the “Site”) is strictly private and confidential and may not be reproduced or redistributed in whole or in part to any other person. By accessing the Site, users are deemed to be representing, warranting, acknowledging and agreeing that the applicable laws and regulations of their relevant jurisdiction allow them to do so and that users have read, agreed to and will comply with the terms and conditions set out herein.

No information contained on the Site should be taken as constituting an offer or invitation to subscribe or purchase to buy, sell or hold any securities of Weiss Korea Opportunity Fund Ltd. (“WKOF” or the "Company") or any entity. The information contained herein is subject to updating, amendment and verification. It should not be relied upon by any persons for any purpose. Nothing in the Site constitutes or is intended to constitute financial or other advice and you should not act upon any information contained in the Site without first consulting a financial or other professional adviser.

For users in the United Kingdom: The Company is not an authorised person for purposes of the Financial Services and Markets Act 2000 (“FSMA”). Accordingly, the information in the Site is provided only for and is directed only at persons in the UK reasonably believed to be of a kind to whom the communication of invitations or inducements to engage in investment activity may be made pursuant to an exemption under the Financial Services and Markets Act 2000 (Financial Promotion) Order 2005, as amended (the "FPO"), including: (i) persons having professional experience in matters relating to investments, i.e. investment professionals within the meaning of Article 19(5) of the FPO; (ii) high net worth companies, unincorporated associations and other bodies within the meaning of Article 49 of the FPO, or (iii) persons to whom it is otherwise lawful to distribute it pursuant to an exemption under the FPO (persons meeting these criteria are referred to herein as "Relevant Persons"). It is not directed at and may not be acted on by anyone other than a Relevant Person. Persons who do not fall within the definition of "Relevant Persons" above should not act or rely on the Site, nor take any action upon it.

While the Company has taken reasonable care to ensure that the information in the Site is accurate, the Company accepts no liability for the accuracy or completeness or use of, nor any liability to update, the information contained in the Site. It should not be construed as the giving of advice or the making of a recommendation and should not be relied on as the basis for any decision or action. In particular, actual results and developments may be materially different from any forecast, forward looking statement, opinion or expectation expressed in the Site.